In January 2026, a series of letters between the Minister of Climate Change, Hon Simon Watts, and the Chair of He Pou a Rangi — the Climate Change Commission — signalled a significant shift in how New Zealand intends to manage its emissions trading scheme. For Alimentary Systems Limited (ASL), these developments reinforce what we have been advocating for years: that gross emissions reduction, not just carbon offsetting, must become central to Aotearoa's climate strategy.

As a company that has engaged directly with government on national climate and waste policy — including our correspondence with Minister for the Environment, Hon Penny Simmonds, on biosolids management, carbon policy, and green fertiliser standards — we are watching these developments closely. The direction of travel is clear, and it is favourable for the kind of circular infrastructure ASL is building.

What the Letters Say

On 18 December 2025, Dame Patsy Reddy, Chair of the Climate Change Commission, wrote to Minister Watts acknowledging the passage of the Climate Change Response (2050 Target and Other Matters) Amendment Bill on 12 December 2025. The Commission outlined several critical implications: decisions on revising emissions budgets have been deferred until 2027, agricultural emissions are now projected higher than expected, the biogenic methane target has been lowered, and agricultural emissions pricing has been pushed to no earlier than 2030. The combined effect is that NZ ETS-covered sectors — energy, transport, industrial processing, and waste — will need to shoulder a greater share of emissions reductions.

Minister Watts responded on 23 January 2026, asking the Commission to consider options with lower auction volumes and/or increased auction floor prices. His letter explicitly sought options that would deliver additional emissions reductions, better position the Government to meet emissions budgets and NDC targets, and help New Zealand go further toward meeting its first nationally determined contribution through domestic means.

On 30 January 2026, Dame Patsy replied, confirming the Commission's statutory independence while acknowledging alignment with the Minister's concerns. She noted that the Commission had already identified the likely need for greater reductions from NZ ETS sectors. However, she flagged that time constraints and analytical limitations mean the April 2026 advice will focus on qualitative assessment of benefits, risks, and uncertainties rather than precise quantification.

Why This Matters for ASL and Impact Investors

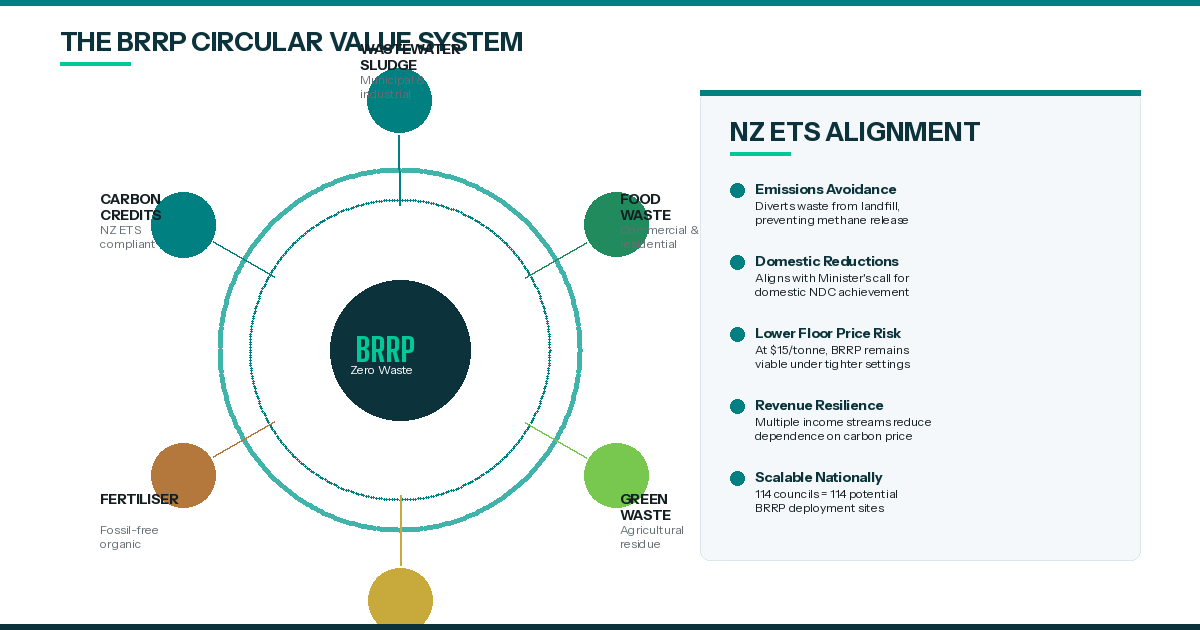

These letters carry several implications that are directly relevant to ASL's Bioresource Recovery Plant (BRRP) technology and to investors considering the circular bioenergy space:

A tightening NZ ETS strengthens the business case for emissions avoidance. Lower auction volumes and a higher floor price mean the cost of emitting rises. For entities operating in the waste sector — where organic material currently goes to landfill and generates methane — the financial incentive to divert that waste and capture value grows in lockstep. ASL's BRRP technology does exactly this: it converts wastewater sludge, food waste, and industrial organic waste into biogas and organic fertiliser, avoiding landfill emissions entirely.

Agriculture's exclusion increases pressure on waste and energy sectors. The December 2025 amendments removed the requirement for NZ ETS settings to accord with nationally determined contributions, and the Government has deferred agricultural emissions pricing until 2030. This means every tonne of reduction must come from sectors already covered by the scheme. Waste diversion and bioenergy recovery become not just environmentally desirable but structurally necessary.

The Government is signalling appetite for domestic solutions. Minister Watts specifically asked for options that help New Zealand meet its NDC through domestic means. ASL's model — processing organic waste regionally, recovering energy and nutrients locally, and preventing the transportation of waste across territorial boundaries — is precisely the kind of domestically grounded, infrastructure-led approach the Government appears to be seeking.

Carbon credit eligibility is becoming more tangible. As the ETS tightens and gross emissions reduction becomes a policy priority, technologies like the BRRP that prevent emissions at source stand to benefit from an evolving carbon credit framework. This has been a central theme in our engagement with the Climate Change Commission and with Ministers, including our discussions with Hon Penny Simmonds on biosolids land application standards and carbon policy.

The Investment Opportunity

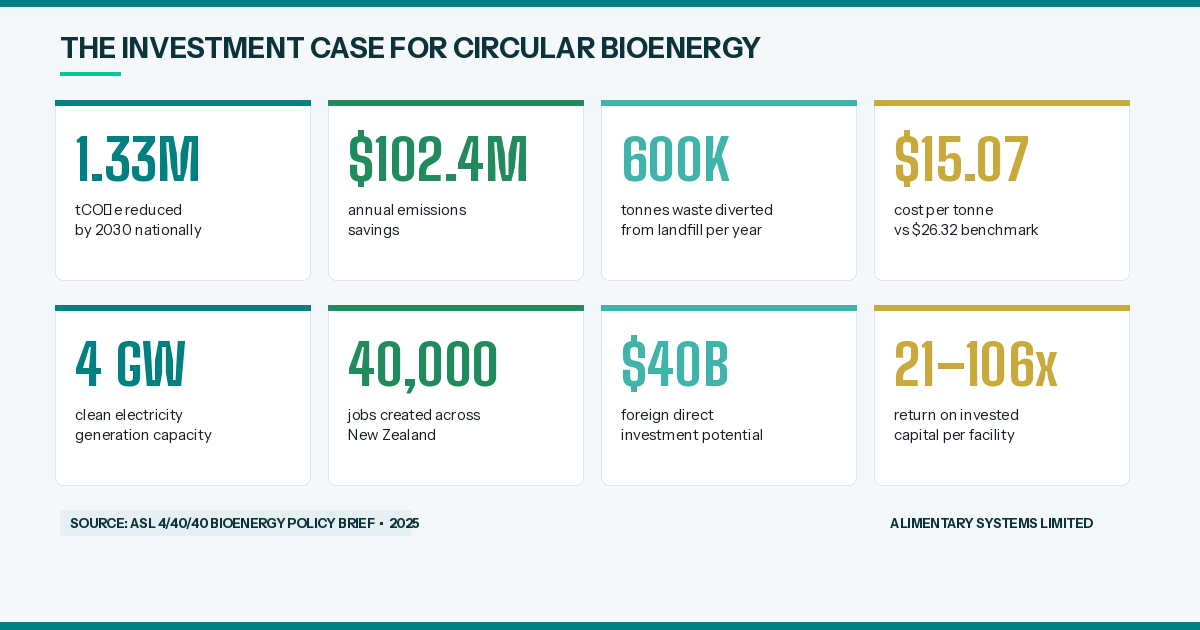

ASL has modelled the economics at both project and national scale. At the facility level, each BRRP can reduce emissions by 82,000 tonnes of CO2 equivalent annually, power over 2,500 homes through methane generation, and create 28 new jobs — with a payback period of 5–8 years and projected returns of 21x–106x on invested capital. The Nelson pilot alone will process 3,600 tonnes of organic waste per year and avoid approximately 4,300 tCO2e of direct emissions annually.

Nationally, ASL's BRRP technology could prevent 600,000 tonnes of waste from reaching landfills each year and reduce emissions by 1,330,000 tCO2e by 2030 — equivalent to 1% of New Zealand's carbon budget — saving an estimated $102.4 million per annum. The BRRP delivers carbon reductions at approximately $15.07 per tonne, well below Treasury's lowest-cost benchmark of $26.32, representing a saving of roughly $11.24 per tonne. Across New Zealand's 114 million NZU stockpile, the total potential savings using this method could amount to approximately $1.28 billion.

The BRRP generates multiple revenue streams — bioenergy sales, fossil-free organic fertiliser (replacing synthetic fertiliser and reducing nitrous oxide), carbon credits from landfill diversion, and reduced wastewater treatment costs — while directly addressing national emissions targets. ASL's Bioenergy 4/40/40 policy framework demonstrates how this infrastructure can generate 4 GW of clean electricity, create 40,000 jobs, and drive $40 billion of foreign direct investment into New Zealand.

The question we are putting to the market is this: as NZ ETS settings tighten, as auction volumes fall and floor prices potentially rise, and as the Government explicitly seeks domestic emissions reduction pathways, how can New Zealand's investment community — trusts, funds, and impact-aligned capital — link their portfolios to the infrastructure that makes these reductions real?

What Comes Next

The Commission's formal advice on NZ ETS settings for 2027–2031 is due by 23 April 2026. Its mid-year emissions reduction monitoring report will address a wider range of prospects for reducing emissions through the NZ ETS and other mechanisms. Both will shape the regulatory environment in which ASL operates.

We will continue to engage with government — across MfE, MPI, and ministerial offices — to ensure that circular bioenergy infrastructure is recognised as a critical pathway for meeting New Zealand's climate commitments. The policy signals are aligning. The technology is proven. The investment case is strengthening.

Now is the time to build.

Alimentary Systems Limited (ASL) is a Christchurch-based circular bioenergy company that designs and builds Bioresource Recovery Plants (BRRPs) to convert organic waste into clean energy and valuable byproducts. ASL works with the Ministry for the Environment, the Ministry for Primary Industries, and government ministers on national policy relating to biosolids, carbon, green fertiliser, and freshwater. For investment enquiries, visit alimentary.systems/invest or contact us at 09 390 4564.

Sources:

- Climate Change Commission, Letter to Minister of Climate Change, 18 December 2025

- Minister of Climate Change, Letter to Commission Chair, 23 January 2026

- Climate Change Commission Chair, Reply to Minister, 30 January 2026

- Climate Change Commission, NZ ETS unit limits and price control settings for 2027–2031